Credit: © KURZ SCRIBOS

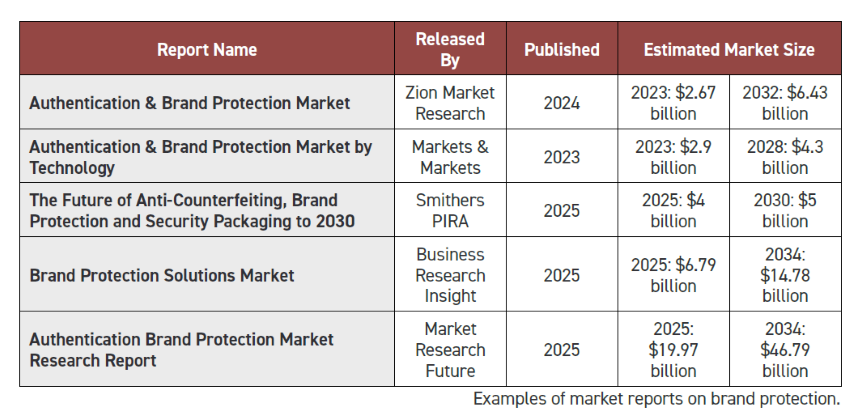

At various industry events and meetings, and on diverse platforms, a perennial question surfaces: what is the true market size of anticounterfeiting technologies in the brand protection domain? Despite this editor’s long experience in this sector, the anticounterfeitingw question has consistently presented a significant challenge.

Throughout my career, I’ve come across numerous published reports presenting various figures, yet a persistent scepticism remains. But the bigger question is, can we genuinely rely on these market reports? Do their authors truly hold the complete answer, or is the complexity of this hidden global issue simply beyond precise measurement by anyone? This article examines a few challenges and provides recommendations for navigating the complexities of market research in this niche sector.

For example, in China and India, where over 200 companies operate in this space, only a handful publish their comprehensive financial data. Even then, isolating their authentication-specific revenue is difficult as it’s often nested within larger divisions. This pervasive lack of transparency severely hampers accurate, bottom-up market analysis.

How does one accurately calculate ‘authentication sales’ when a company supplies security labels that include authentication features but are sold primarily as packaging components? Isolating the size of the authentication business within such diverse and often blended operations is exceptionally challenging.

To conduct meaningful research in authentication and brand protection, one must clearly define specific data needs, whether by technology, industry, or region. Collaborating with trusted, specialised research firms or consultants with proven expertise, joining industry associations like the IOTA & ITSA, and subscribing to journals for credible insights, all offer a significant advantage.

When reviewing syndicated reports, it is important to verify the publisher’s credibility, data sources, the number of companies surveyed, and the methodology, as well as ensuring the scope of the report aligns with your goals.

Buying syndicated reports might seem quick and easy, but they carry certain risks. The authentication and brand protection sector is specialised and complex, requiring precise, context-specific data for building effective strategies. Although market research is useful, it must be evaluated critically. Success relies on insights that go beyond surface figures to tackle real counterfeiting issues.